Credit cards for your convenience

The use of credit cards in this day and age is growing its popularity, especially since people don’t really like carrying cash with them. Credit cards are a valuable tool for traveling, handling emergencies or expenses, and building credit, and is a very safe way to travel with convenience.

Most credit cards also offer rewards that let you earn cash backs or reward points for merchandise and flights.

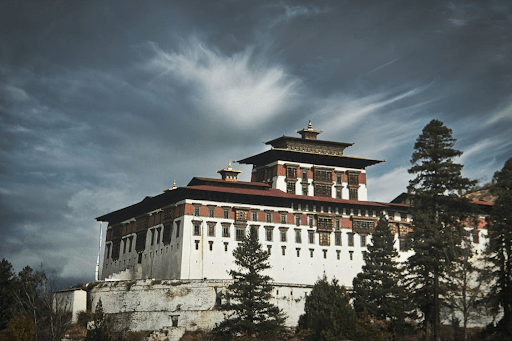

Bhutan gaining popularity in attracting many tourists every year has led to rapid development in the tourist sectors, and for the convenience of the tourists, credit cards are now widely accepted in the country as a mode of payment. Except for a few rural areas, many handicraft shops and luxury hotels in Bhutan now accept Visa and MasterCard.

- Credit cards for Travelers (Locals)

Credit cards for the locals

Following are the credit cards offered by the two major banks in Bhutan to the locals.

- Bank of Bhutan Ltd.

BOBL’s Corporate credit card

In 2012, the Bank of Bhutan Ltd. launched BOBL’s Visa Credit Cards exclusively to Bhutanese citizens. The domestic Credit Cards are accepted at payment terminals, and the international Credit Cards can be used for any online shopping and POS (Point of Sale) transactions/purchases. The bank also provides Corporate Credit Cards that can be used by selected employees of the organization, which is accepted worldwide. These cards are issued with the aim to provide a convenient way of managing official tours and travel related expenditures, such as hotel bookings, purchasing air tickets, etc.

- Bhutan National Bank Ltd.

BNB card- your relationship bank

In 2005, the BNBL launched Bhutan’s first globally accepted Gold Visa Credit Cards. The card is valid for 4 years, and as per the Royal Monetary Authority regulation, the maximum annual limit on credit cards is USD 1,000 and INR 50,000 per month. BNBL also provides Corporate Credit Cards that have higher limits. Other types of Credit Cards provided by the Bank are:

- Salary based Credit Cards

- Collateral based Credit Cards

2. Credit cards for Travelers (Tourists)

Credit cards for international tourists

Credit cards can be a highly useful tool for traveling, handling unexpected expenses, earning rewards, and improving credit when used properly. With so many top tourist sites and luxurious hotels in Bhutan, international tourists travelling for vacations and holidays in Bhutan are frequently using credit cards. The following are the most widely used credit cards by tourists who visit Bhutan.

- American Express- Gold Card

American express credit cards

The American express card offers substantial returns at restaurants, airfares, and other expenses which are best for any traveler.

- American Express- Platinum Cards

Platinum cards for luxury travel

The American express platinum card is a high-end card designed for high-end travels, but if you are willing to be treated like a VIP while traveling then this card offers handsome rewards to its users.

If you travel a lot in and outside your country, then the business platinum card is the best choice.

- Visa- Credit Cards

Visa- It’s everywhere you want to be

Visa is one of the most popular and widely accepted credit cards worldwide. These cards are accepted in around 200 countries and territories. There are many different tiers of visa cards, such as the visa classic, platinum, signature, and infinite, which are the personal visa cards. Different business tiers include, visa business, signature business, and infinite business. It is best to get a card that best suits your purpose of visit, whether it is for business or for Bhutan vacation.

- Mastercard Credit card

There are some things money can’t buy. For everything else there’s Mastercard

Mastercard is the most extensively accepted payment network throughout the world. It is accepted with more than 37 million merchant locations in more than 210 countries and territories. Different tiers of Mastercard includes, standard, gold, platinum, world, and world elite mastercard. To find the ideal credit card, consider how often and where you will be making most of your purchases and what kind of charges are involved.

For instance, if you want to enjoy the best luxury hotels in Bhutan, world elite mastercard would be the ideal choice for you, since you can get discounts on rooms at selected luxury hotels.

Both the visa and mastercards cards are recognised worldwide and they are equally well-accepted and offer similar benefits to the cardholder. Most Indian travelers use these types of credit cards when they travel for Bhutan vacation and holidays.

Between six months, you should consider closing no more than one credit card. It’s important to note that even if you don’t close them all at once, but rather one at a time, it will still have a negative influence on your credit score.

Conversely, it is critical to obtain the credit card that best meets your needs in terms of how frequently and when you use the card. Earned points and miles can be redeemed for flights, hotel stays, and other valuable prizes. Many cards, especially premium travel rewards credit cards, provide annual perks worth hundreds of dollars. The better the perks, the higher the tier, but that does not mean you are entitled to all of the benefits associated with that tier. In some cases, the credit limit you receive when your card is accepted will determine your card tier.

These credit cards for travelers are the most used for their expenses,whether they are travelling for Bhutan vacation or for business purposes. Credit cards help you to establish a credit history while also providing effective security safeguards in the event of fraud or card theft. Having more than one credit card is not a terrible idea because it helps you manage your balances and improves your credit utilization. It simplifies your life, especially when you’re traveling; it helps you book reservations and make emergency expenses.

Are you looking to travel to Bhutan for vacation? Here are the Bhutan Vacation Packages that might come in handy.

Recent Comments